Crypto “currency” in Tunisia: an official choice to remain silent.

Abstract

Through its various ramifications, crypto has been at the core of the debate since 2009.

Lately, cases persecuting young information technologists or simply enthusiasts, confiscating mining material, applying Anti-money laundering frameworks have also been at the core of the debate.

Economic rights and freedoms enshrined through international conventions, the Tunisian constitution and special legislation are being discussed, unofficially, more than ever.

Principles such as the principle of legality of crimes and punishments are being challenged through expanding the scope of crimes contrary to the narrow interpretation in the criminal law principle.

This article is a humble glance at the general situation of Tunisia as to the classification of cryptocurrency in comparison to chosen countries from 2 different continents. The comparison comprises the highroad that could be taken to deal with Bitcoin and other derivatives as technologies that are disruptive vis à vis the central financial system.

CRYPTOCURRENCY IS NOT LEGAL TENDER

It seems noteworthy to commence by a key question: should penalization go hand in hand with the principle of narrow interpretation in order to guarantee the rights of individuals and society? It seems noteworthy to concentrate on the issue of the absence of a specific legislation catering cryptocurrency in Tunisia.

So how are Crypto transactions managed? and how are persons prosecuted for crypto mining and crypto trading in Tunisia?

What the Tunisian public prosecution is doing is not estrange to the démarche used by most judiciaries around the world to this day i.e. applying other existing provisions that were not meant to include crypto “currency” within its scope at the date of their drafting to crypto activities.

Contrary to other jurisdiction, the bone of contention consists in the complete legislative void. Indeed, this is reflected through the absence of legislation including administrative decisions, circulars or notes. Collided with the lack of resorting to experts during trials, it could lead to applying freedom-depriving punishments.

The Tunisian approach

In an attempt “to protect the country from the dangers of money laundering” and on the 20th of April 2021, the “frozen” Deputy Yassine Ayari published on his official Facebook page a law proposition aiming to complement the law N°18-76 dated on the 21st of January 1976 through adding an additional chapter entitled ‘Cryptocurrencies-العملات الرقمية”. This ‘bill’ contains 17 articles in total.

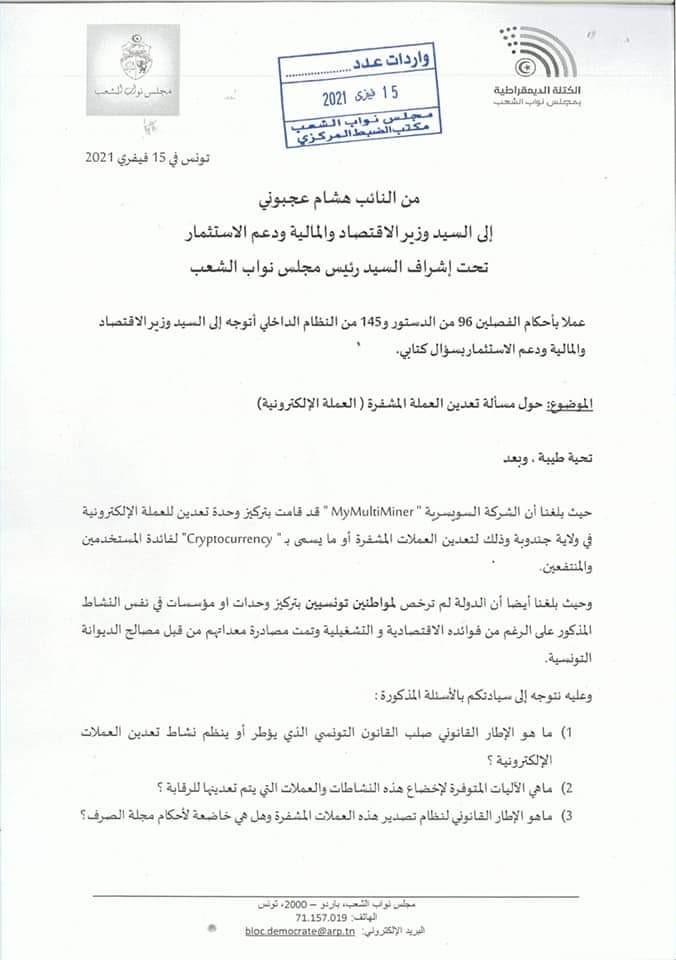

This is the 1st time a Tunisian deputy accords attention to the subject right after Deputy Hichem Ajbouni directed a written question to the Minister of Economy, Finance and Investment Support about the concentration of a mining unit “ MyMultiMiner” in the governorate of Jendouba, on the 21st of February 2021.

جواب الوزير المذكور لم يتم نشره للعموم رغم الاهتمام الكبير من الشباب والمختصين خاصة في ظل المظالم والمضايقات التي يتعرض إليها الناشطون بالمجال على غرار الشاب حسام بوقرة. تعرض النائب لنقاط محورية في سؤاله الكتابي وهي :

- الإطار القانوني لنشاط تعدين العملات الإلكترونية كما أطلق عليها.

- الاليات المتوفرة للرقابة عليها.

- الإطار القانوني لنظام تصديرها ومدى خضوعها لأحكام مجلة الصرف.

The answer of the aforementioned minister has not been communicated to the public despite the huge interest, especially among the youth and IT professionals, to finally get hold of a public statement about crypto “currency” and even in light of the recurrence of injustices against Tunisian youth such as Houssem Bouguerra “accused of mining”. The deputy’s questions seem to go straight to the core issues :

– the legal framework regulating the activity of Mining ( especially in the light of the license given to the swiss company)

-the existing mechanisms to monitor its activity,

– the legal framework to “export” these “currencies” and whether the law n° 18-76 is applicable to these transactions.

One of the most important pioneers regarding the issue at hand is to determine whether this virtual asset is legally a currency or not. De jure, in Tunisia, this is one of the least controversial questions and most direct to answer. For it to be recognized as currency it has to enjoy the legal tender requirement ( le cours légal).

This requirement refers to being “money” in the eyes of a jurisdiction’s financial laws. Usual money (fiat currency) such as the dinar or euro do enjoy this recognition. In order to be “blessed” with this characterization, the currency has to be recognized explicitly by a legal text.

Indeed, Article 14 of the 2016 Act NO° 35 dated 25th of April 2016 relating to fixing the status of the Central Bank of Tunisia states that the only legal tender accepted is the one emitted by the Central Bank i.e., the Tunisian dinar . Regardless of how extreme their positions are, at least in this sense, Tunisia joins many states around the world like the US, Canada, Singapore, South Korea, China, India, Estonia, Luxembourg.

As such, crypto “currency” does not have the ability to replace the Tunisian dinar.

It is important to mention that the above-named countries have not resorted to applying criminal provisions unless the conditions of the related crimes are proven to be united. This is the case for the money-laundering crime. Applying criminal provisions should be accompanied by a set of guarantees, the fact-finders are bound to take into consideration the situation of the accused and that depriving an individual from his/her freedom should be a necessary exception, a recourse whenever society is threatened.

جاءت ادانة النائب المجمد ياسين العياري على خلفية تدوينة اتهمته على اثرها النيابة العامة العسكرية بـ” المشاركة في عمل يرمي إلى تحطيم معنويات الجيش بقصد الإضرار بالدفاع والمس من كرامة الجيش الوطني و معنوياته”, وقد اصدرت على اثر ذلك العديد من الجمعيات والمنظمات الحقوقية الوطنية والاحزاب السياسية التونسية بيانات تنديد بمحاكمة مدنيين امام القضاء العسكري.

A comparative approach

Since Tunisia is a continental law (civil law) country, the French example seems to have the potential of being the closest for several reasons that are out of the scope of this article.

In France , in 2019, la loi PACT (PACTE – Action Plan for Business Growth and Transformation[4]) was issued. This law provides detailed regimes for crypto-assets and caters crypto transactions as well as the regulatory bodies’ interventions and manages issuer-investor relations. Continuing with the French example, in a recent decision dated February 26th 2020, the Nanterre commercial tribunal gave a clear classification of cryptocurrency through classifying Bitcoin. The case involved a French exchange platform of bitcoin “Paymium ” and an English financial consulting company that specialises in cryptocurrency consulting including bitcoin “Bitspread”. The latter conducts arbitration between different platforms to sell cryptocurrency at the best price as a market maker. The Court ruled upon several issues including the classification of bitcoin which it stated that it is a consumable and a fungible good (but not a currency, joining explicitly therefore the Tunisian implicit way).

Another crypto heaven is Singapore. The country proceeded by way of elimination as it disregarded virtual “currencies” as legal tender. Then, Jurisprudence emanating from the international commercial court of Singapore added value to government’s choice through the holding in B2C2 Ltd V. Quoine Pte Ltd (2019). In that decision, the court considered crypto “currencies” as “Assets” and “personal property” which is the same conclusion that the Monetary Authority of Singapore (MAS) reached.

Conclusion

As demonstrated, The Tunisian legislator needs not to recognize crypto assets as currencies, like El Salvador chose on the 9th of june 2021, neither does it need to jeopardize its financial systems nor its national currency in order to benefit from its economic and technological advantages as well as prevent injustices vis à vis youth. Simply, Tunisia needs to view economic growth opportunities with vigilance.

Also, the state could join other jurisdiction which are taxing crypto transactions provided that it takes into account the peculiarity of this activity, the market capitalization and the size of the companies offering crypto services, in order for taxation to not become a hurdle in the way of economic growth.

Finally, the lack of official statements and institutional positioning is sending Tunisian youth behind bars and ruining their futures every day. The silence of the relevant authorities such as the Central Bank of Tunisia, le Conseil du Marché Financier and La Commission Tunisienne des Analyses Financières in conjunction with the general fact of the slow and long judicial procedures are depriving Tunisia from its youth and huge investment opportunities. Opportunities which Tunisia is in dire need for.